Zerodha Account Opening Process : In this article, you will find complete information about opening a demat and trading account in Zerodha? Such as documents required to open a demat account, account opening charges (fees), online and offline process of account opening (Step By Step). If you follow the instructions in this article, your account will be successfully opened in a single attempt.

At present, Zerodha is the No. 2 stockbroking firm in India. Zerodha is located in Bangalore and was established in 2010 by Mr. Nitin Kamath. Zerodha provides trading and investment services in Equity, Currency, Commodities, and Mutual Funds.

Zerodha introduced the Discount Brokerage model in India. Zerodha became very popular in a very short period of time due to their discount brokerage model. Zerodha currently has over 75 lakh, active clients.

There are many stockbrokers available in India to open a demat and trading account. Even so, many people prefer Zerodha to open a demat account.

There are plenty of reasons to open a demat and trading account in Zerodha.

Some of that:

Below is a list of required documents to open an account with Zerodha.

Zerodha account opening charges are as follows :

Type of account | Trading And Demat |

Online account | Free |

Offline account | Free |

Demat AMC | Rs 300 + GST |

Current Zerodha offers for new account opening. (Limited Period Offer)

There are both online and offline facilities available for account opening in Zerodha. If your Aadhaar card has a linked mobile number, you can open an account online. But if the mobile number is not linked to the Aadhaar card, then you can go with the offline process.

Opening Zerodha demat account through an online process is very easy and fast. This process takes a maximum of 15 to 20 minutes to complete.

So, let’s open Zerodha account online.

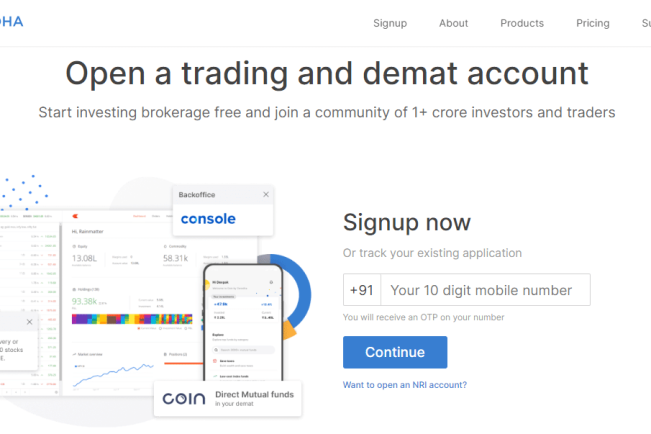

Start the process of account opening in Zerodha by clicking on “Open An Account”. You will be redirected to Zerodha’s website.

Step 1 –

Enter your 10 digits mobile number here and click on continue. You will receive an OTP from Zerodha.

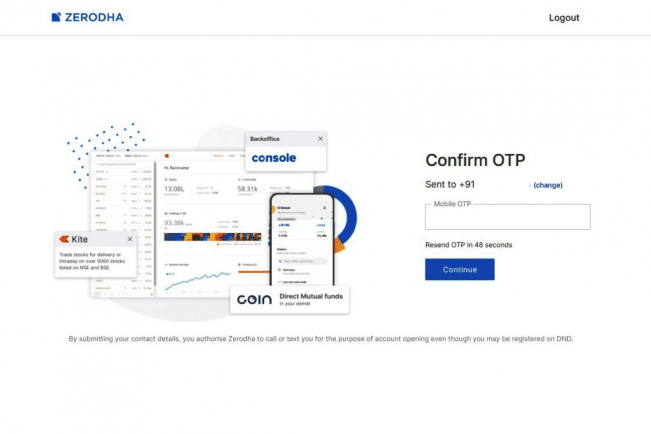

Step 2 –

Enter the OTP you received and click on continue to verify your mobile number.

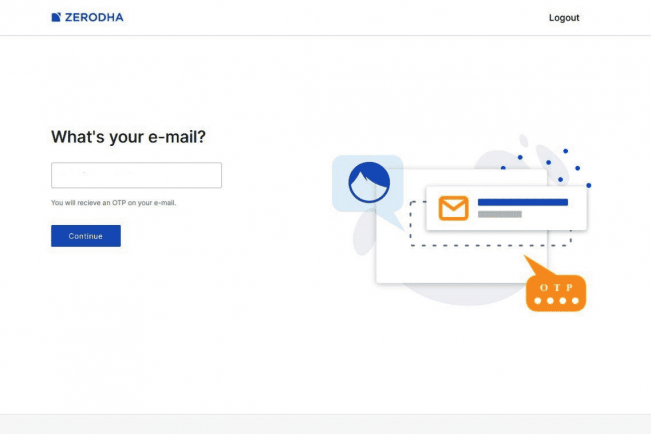

Step 3 –

Upon successful verification of your mobile number, you will be asked for your e-mail id to verify. Enter your e-mail id and click continue. You will receive an OTP in your e-mail. Verify your e-mail id by entering OTP.

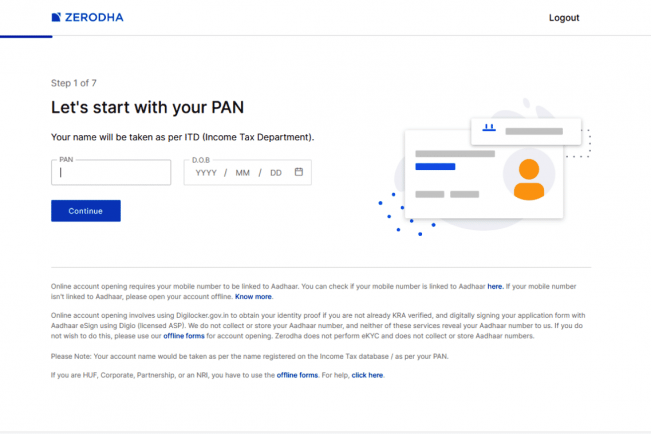

Step 4 –

Now enter your PAN number and Date Of Birth and click on continue.

Step 5 –

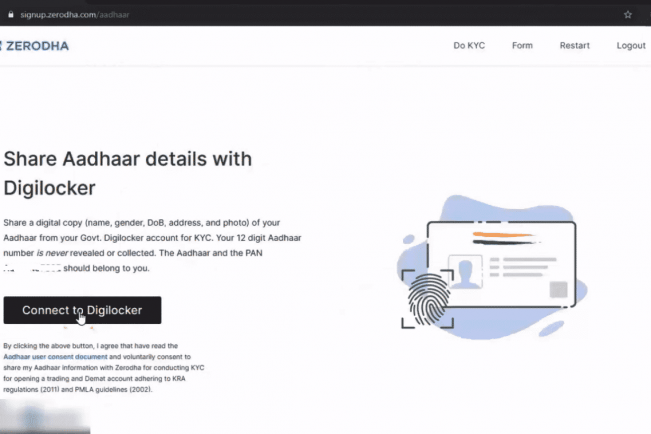

After filling in the PAN number and Date Of Birth, you will have to verify your Aadhaar number. For this, you need to connect to Digilocker. Digilocker is an initiative of the Government of India, where you can keep your important documents extremely secure. So now click on “Connect to Digilocker” to proceed.

Step 6 –

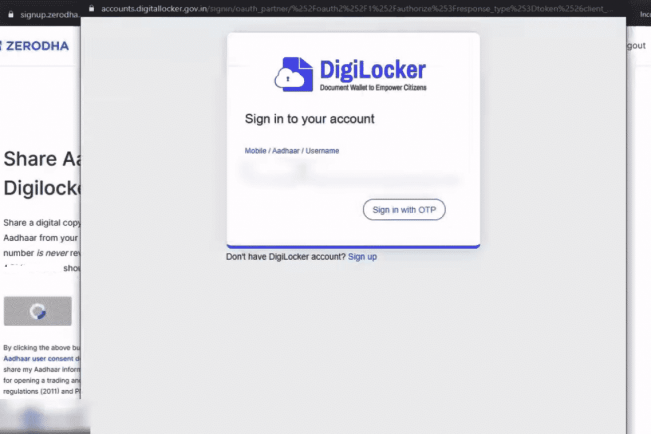

Now enter your 12 digit Aadhaar number in Digilocker and click on “Sign in with OTP”. If you do not already have a Digilocker account, you can open a new account by signing up.

Step 7 –

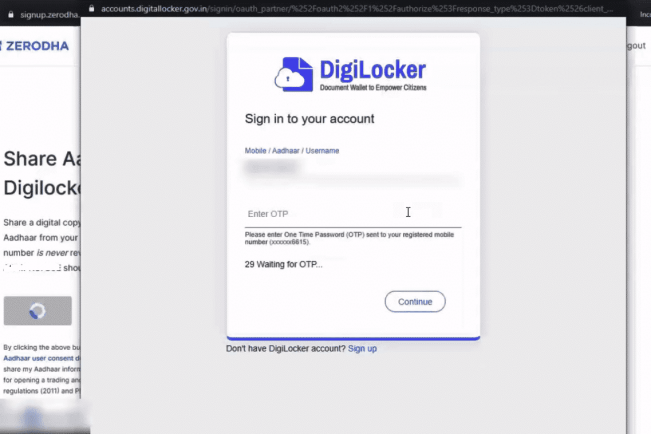

To verify your Aadhaar, enter the OTP received on your mobile number and click on continue. After that, you have to create a security PIN.

Step 8 –

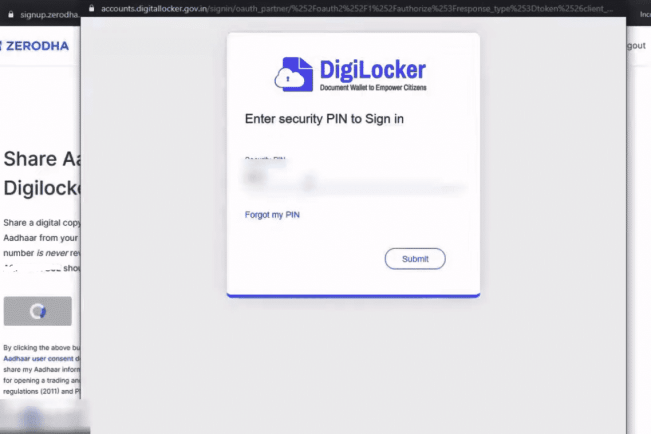

Now, enter the security pin to sign in and click submit.

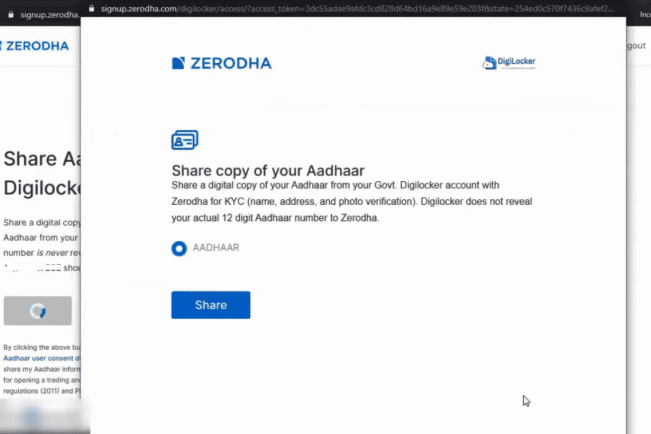

Step 9 –

Now click on “Allow” to grant access of Digilocker to Zerodha. By doing this, your Aadhaar details will be automatically fetched. If your Aadhaar details are correct, click on “Share”. This will allow a digital copy of your Aadhaar to be shared with Zerodha so that your name, address, and photo can be verified.

Step 10 –

Once the Aadhaar is verified, you will need to provide your personal details such as marital status, father’s name, mother’s name, annual income, trading experience.

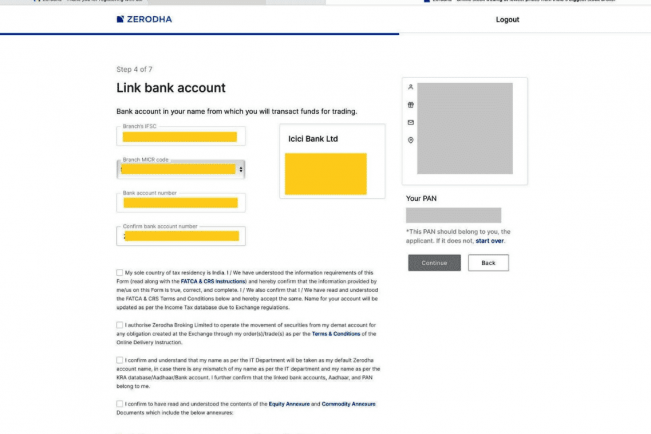

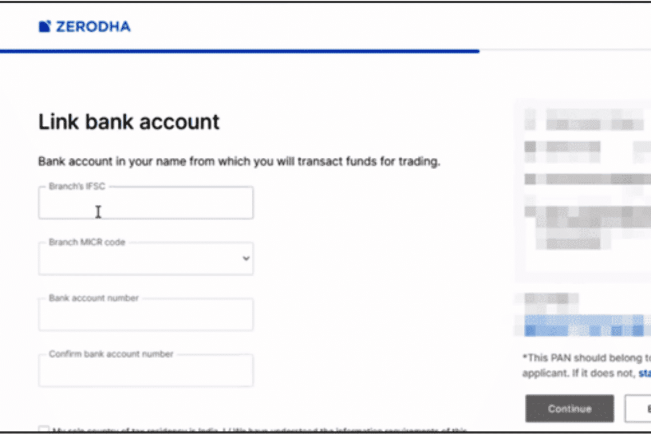

Step 11 –

Now you need to link your bank account with Zerodha. One thing to mention here is that only from this bank account you can pay in to Zerodha and only in this account Zerodha can payout your money. Feel your bank’s IFSC, MICR, and account number here and click on Continue.

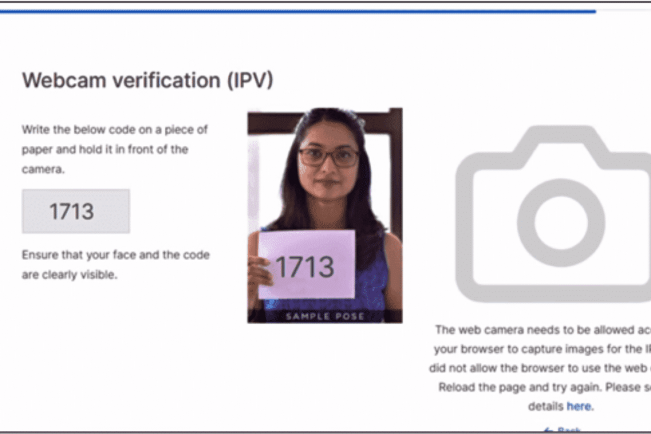

Step 12-

After the bank details are mentioned, there is a step of in-person verification. In this step, you have to show the received OTP along with your face in front of the webcam. Click Start IPV. Now make sure your face and OTP are clearly visible. Now click on “Take Video” and then click on “Save Video”.

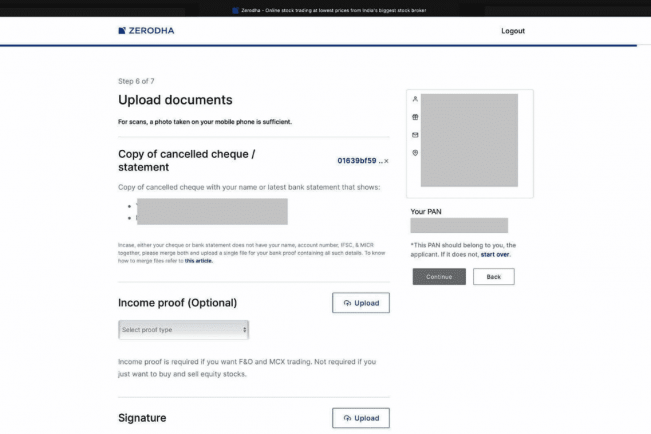

Step 13 –

Next, upload your documents including canceled cheque or bank statement, income proof, signature, and PAN card.

Before uploading a canceled cheque or statement, make sure that your Name, IFSC code, MICR code, and Account Number are clearly visible on it. In the case of a bank statement, it must have the logo of the respective bank on it.

If you want to trade in futures and options or currency or commodity then you should upload income proof otherwise it is optional.

After uploading all the required documents, click on the “Continue” button that appears on the right side of the screen.

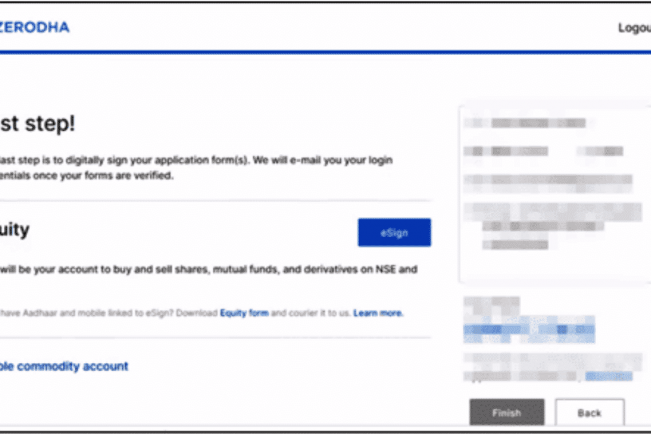

Step 14 –

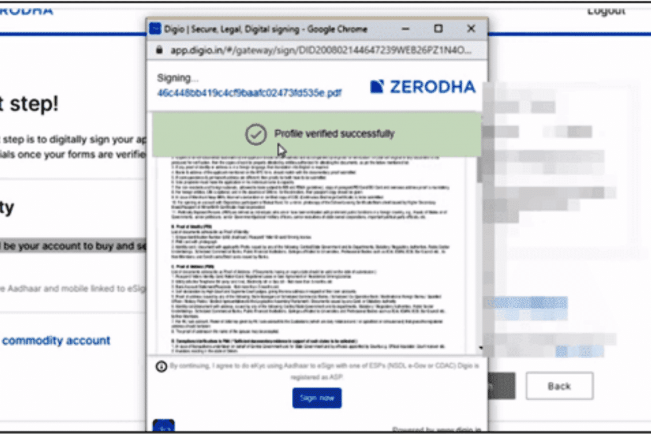

This is the last step in the Zerodha account opening process. Click on “eSign” to digitally sign your application.

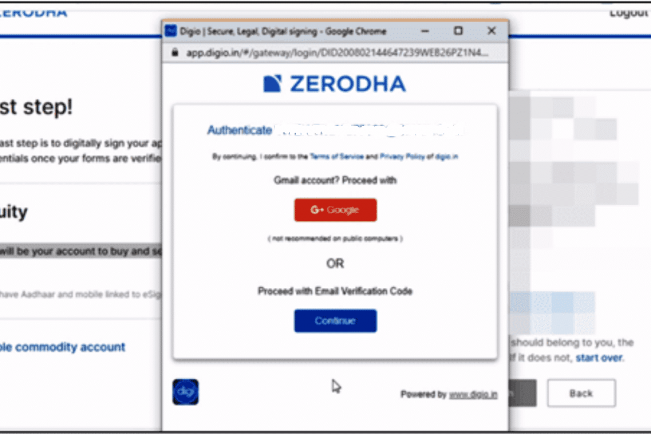

Step 15 –

Once you click on eSign you need to verify the e-mail. Here you will get two options like Google Account or E-mail id. If possible, choose ”Proceed with e-mail” and enter your e-mail id without any spelling mistakes. This is because you will receive all future correspondence from Zerodha on this e-mail id. Now verify the e-mail id by entering OTP which you received in your e-mail.

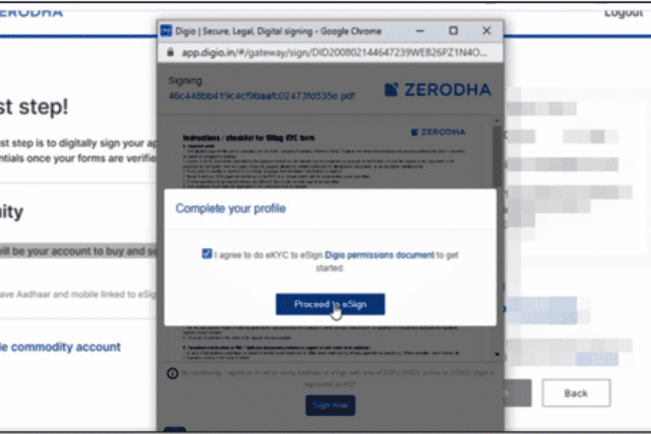

Step 16 –

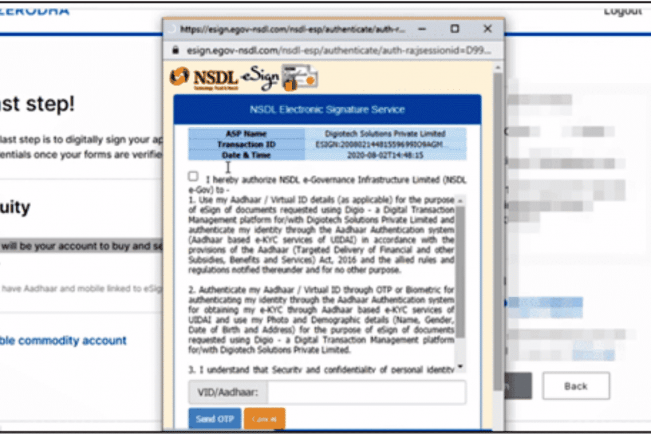

Click on the check box stating “I agree” and then click on “Proceed to eSign” It will redirect you to the NSDL page.

Step 17 –

After reaching the page of the NSDL, click on the checkbox that shows “I hereby” and then enter your aadhaar number and click on send OTP.

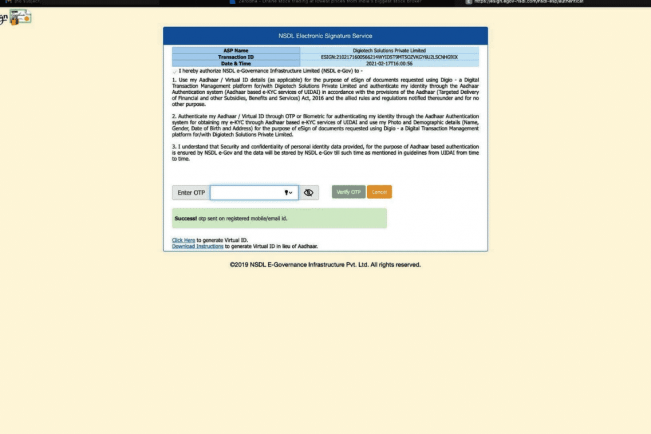

Step 18-

Now complete your Zerodha account opening process by entering the OTP.

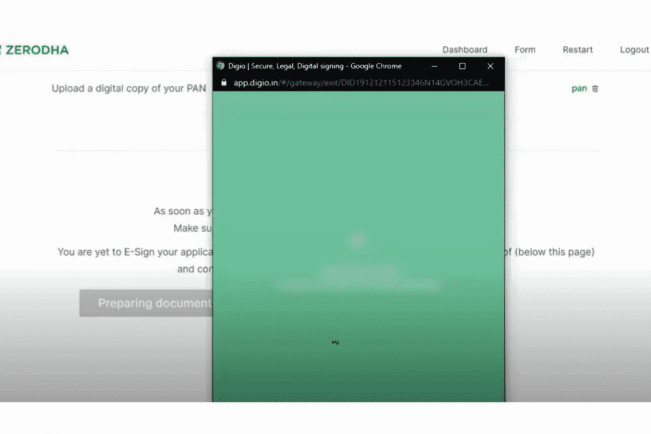

Step 19 –

After completing the process you will see the green background screen with the message stated “You have successfully signed the document” this screen will appear only after all your process is complete and verified.

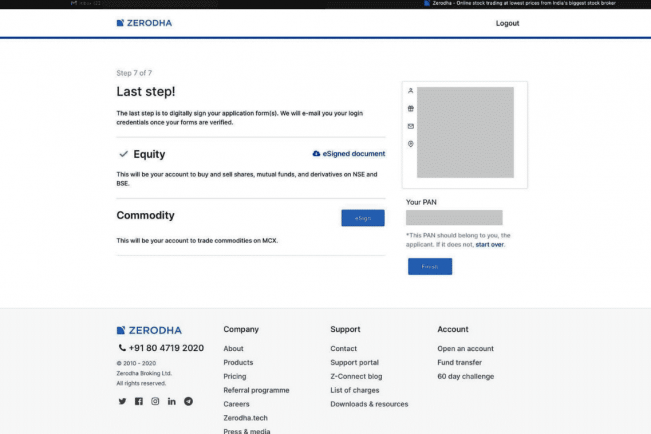

Step 20 –

Now you will find the tick mark to the equity section.

Now, your form for the Equity segment is successfully filled. But if you want to trade in commodity also, click the eSign button in front of the Commodity segment. This will open your account in the commodity segment.

Step 21 –

You will again be redirected to the NSDL page. Click on the checkbox that shows “I hereby” and then enter your aadhaar number and click on send OTP. And complete your Zerodha account opening process by entering the OTP.

Step 22 –

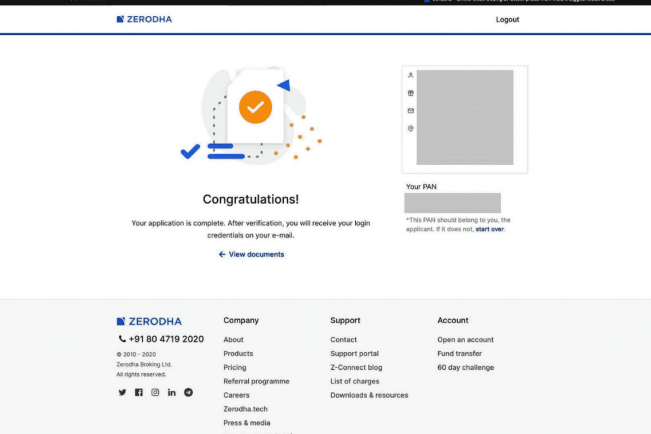

After completing all the above processes, you will see the message of Congratulations on your screen.

Once you complete the Zerodha account opening process, your form and documents will receive at the Zerodha KYC team. KYC team will verify your documents and will open your demat and trading account in Zerodha. After opening the account you will be informed by e-mail. You will get your login credentials in this same e-mail. This process takes around 24 working hours to open your account.

If your Aadhaar does not have a linked mobile number then you can choose the offline account open process. The offline process of opening an account in Zerodha is a bit longer than the online method. This process takes about 6 to 7 days to open your account.

Let’s see how to open an account in Zerodha offline.

Step 1 – Download the Application Form from the Zerodha website or you can download it below.

Print the complete form.

Step 2 – Fill the complete form accurately and sign it.

Step 3 – Attach all the necessary documents.

Step 4 – Send the duly signed form with attached documents to the below address.

Zerodha H.O No.153/154, 4th Cross Dollars Colony, Opp. Clarence Public School, J.P Nagar 4th Phase, Bangalore – 560078

Once your application reaches the Zerodha office, the Zerodha KYC team will check and verify your form and your documents. After checking your application, your account will be opened. In the case of an offline account opening, Zerodha takes up to 2 working days to open your account.

Congratulations! All the processes of the Zerodha account opening have been completed.

If you still have any queries or need help regarding account opening/form filling, you can contact the Zerodha account opening helpline at 8047192020 or 8071175337 between 9.00 AM to 6.30 PM.

Once you have completed the online account opening form, it takes 24 working hours to open your account in Zerodha. After account opening, you will receive an email with your login credentials.

If you do not receive the account opening email within 24 working hours, you can check the status by visiting Zerodha website.

After successfully opened your account in Zerodha, you can start trading or invest in the stock market through the Kite trading platform.

Below are the links to the Zerodha Kite trading platform

Kite Web: https://kite.zerodha.com/

Kite App for android: https://play.google.com/store/apps/details?id=com.zerodha.kite3

Kite App for iPhone: https://apps.apple.com/in/app/kite-zerodha/id1449453802

After reading How To Open Demat And Trading Account In Zerodha?, you are ready to open your own account in Zerodha. You can start the Zerodha Account Opening process here. If you have any queries, leave a comment below.

Yes from 29 June 2024, Zerodha removed the ₹200 account opening charges and shifted to a free model.

Zerodha was founded in 2010 by Mr. Nithin Kamath and Mr. Nikhil Kamath. Since its inception, the company has proved itself by overcoming the challenges it faces. Today, Zerodha is the largest stock broking firm in India. Both Nithin and Nikhil are the wealthiest self-made billionaires in India.

Zerodha demat account is usually opened within 24 working hours. But if it does not open for some reason, you can check the account opening status by visiting the Zerodha website.

Yes, it is safe to open an account in Zerodha.

Zerodha is a member of reputed exchanges like NSE, BSE MCX and is regulated by SEBI. Also, they have stopped doing proprietary trading since 2019.

All these things make Zerodha a safe stock broker.

Zerodha offers a discount brokerage model. In this model, Zerodha charges a flat brokerage of Rs 20 or 0.03% (whichever is lower) per executed order across equity, currency, and commodity for intraday trades. It charges zero brokerage for equity delivery and direct mutual funds.

In short, for any trade in Zerodha, you do not have to pay a brokerage charge of more than Rs.20.

Opening an account online is the fastest way to open a Zerodha account.

Here you can fill out the Zerodha online form. After filling up the online form, you must upload the required documents for account opening. Validate your form and documents with Aadhaar OTP.

This process does not take more than 20 minutes to complete. After completing the process, your Zerodha account is opened within 24 working hours.

Some mandatory documents are required when opening a Zerodha account.

Such as PAN card, Aadhar card, address proof, cancelled cheque, photo, and income proof.

Aadhar card is mandatory if you want to open an account online.

Yes, you can open a Zerodha account offline.

Download the Zerodha account opening form and print it. Fill in the appropriate information in the form and attach the required documents. Send the form along with documents to the Zerodha office address. Your account will be opened in 48 hours after the form reaches the Zerodha office.

Yes, you can apply IPO through Zerodha account.

Beginner-level traders need lots of help. Beginners do not know the terms of the stock market, nor do they know how the stock market operates, how to trade, which shares to buy, which shares to avoid, how to make a profit, and protect money from loss. So they need assistance.

Although Zerodha does not provide this type of personal assistance, their varsity education program has everything a beginner needs.

Apart from varsity, Zerodha’s support portal and a discussion portal named Trading Q&A. These portals are especially useful for beginners. You can resolve your queries on this portal.

This makes Zerodha a great option for beginner traders.

Anyone who is a citizen of India can open a trading and demat account in Zerodha with valid documents. Anyone like employees, businessmen, housewives, and students can open a Zerodha account. You can also open non-individual accounts in Zerodha like Company Account, Partnership Firm, LLP, Hindu Undivided Family, Trust Account, and Association of Persons.

Follow below given steps to open Zerodha account online.

After completing above steps, your Zerodha account will be opened within 24 working hours.

Annual maintenance charges (AMC) for the demat account in Zerodha are Rs 300 + GST. Zerodha charges this fee every quarter. The AMC amount is Rs 75 + GST for every quarter.

There are several benefits to opening a Zerodha account.

Zerodha account opening process takes up to 48 working hours to open an account.

It takes 24 working hours for the online process and 48 working hours for the offline process to open account in Zerodha.

If your payment was successful but the process got interrupted, don’t worry. You can check your payment status by logging in again on Zerodha’s account opening page using your registered mobile number or email.

If the payment is traced, you’ll be able to continue from where you left off. If it doesn’t reflect, keep your payment receipt handy and raise a support ticket on Zerodha’s help portal for quick assistance.

Read the complete Zerodha Broking Review.

3 thoughts on “Zerodha Account Opening Process”

In FAQ it is not mentioned for the case when money Rs200/- is paid and disconnected due to networking issue ,then how to continue and how to trce our payment

I found this article very informative about zerodha account opening charges. The pros and cons section offered a balanced view, helping readers assess whether Zerodha Demat account is the right fit for their trading needs. Overall, a valuable resource for anyone looking to explore Zerodha as their brokerage choice. Thanks

Thanks for share zerodha account opening process. It help me a lot.