AMO in Zerodha Kite means placing After Market Orders (AMO) through the Zerodha Kite platform. These orders are placed after trading hours for execution in the next session. Zerodha provides this facility for traders and investors who can’t participate during live market hours (9:15 AM to 3:30 PM).

With AMOs, you can plan trades at your convenience, avoiding the pressure of market volatility. Many new users wonder, “what is AMO in Zerodha Kite, and how does it work?” — it’s essentially a way to pre-schedule your trades.

An AMO (After Market Order) allows you to queue buy or sell orders when the stock market is closed. These orders are stored in Zerodha’s system and sent to the exchange when trading begins.

Here’s what happens step by step:

You place an AMO in Zerodha Kite after the market closes.

Your order goes into Zerodha’s AMO file.

At market open, Zerodha’s RMS submits the order to the exchange.

The order executes if your price matches the market price.

Key facts about AMO execution:

AMOs are ideal for traders who can’t trade live during market hours.

Execution depends on your order type (Market or Limit) and price match.

AMOs do not incur extra Zerodha AMO charges; regular brokerage applies.

Many prefer AMOs to avoid the morning market rush and trade calmly.

Zerodha AMO timings vary by segment:

Equity Timing: 3:45 PM to 8:57 AM for NSE

3:45 PM to 8:59 AM for BSE

F&O Timing: 3:45 PM to 9:10 AM

Currency Timing: 3:45 PM to 8:59 AM

MCX Timing: AMO orders in MCX can be placed anytime during the day. If an order is placed during the market hours the order will go through the next day at 9 AM.

Understanding Zerodha AMO order timing helps ensure your order enters the market at the right time.

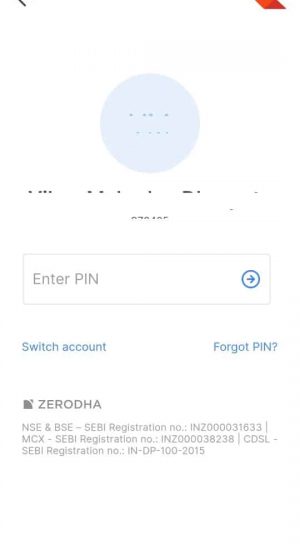

Enter your client ID, password, and PIN.

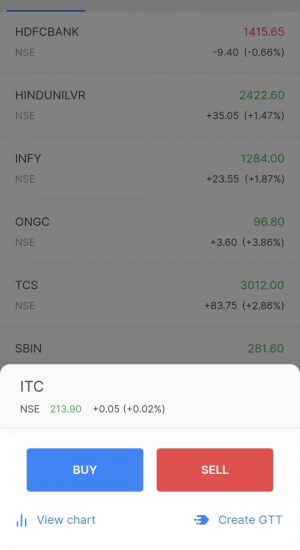

Search for the stock, analyze its price, and decide on the order type.

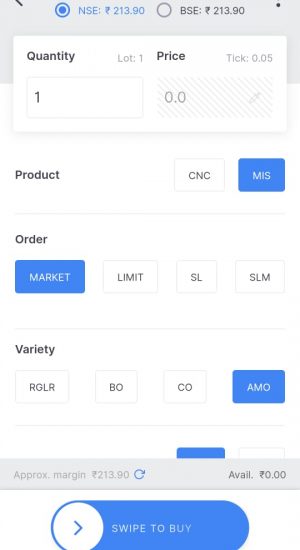

Select AMO, enter price, quantity, and product type (MIS, CNC, NRML), then confirm.

Once you know how to put AMO order in Zerodha, you can schedule trades even on weekends and trading holidays.

AMOs can’t be placed during live trading hours.

Valid for all product types (MIS, CNC, NRML) but not BO/CO orders.

Stop-loss orders aren’t available as AMOs.

You can modify or cancel AMO orders any time before they’re sent to the exchange (usually up to 8:57–9:10 AM depending on the segment).

No additional Zerodha AMO order charges; regular brokerage applies.

AMOs are best for pre-planning trades and avoiding volatility at the opening bell.

AMO in Zerodha is perfect for traders who can’t track markets live. It lets you plan your trades, lock in prices, and avoid missing opportunities. Understanding AMO timings in Zerodha, knowing when AMO orders are executed, and learning how to place AMO in Zerodha Kite can make your trading more efficient.

It queues your order after market close and sends it to the exchange at market open. Execution happens if your set price matches the market.

Valid until the next trading day’s opening. Unexecuted AMOs can remain pending or get canceled based on your order type.

No, Zerodha doesn’t charge extra for AMOs. Standard brokerage and statutory fees apply.

There’s no special AMO limit. It depends on your available margin, segment rules, and Zerodha account limits.

Limit AMOs execute only at your specified price. Market AMOs execute at the market price when trading opens.

You can modify or cancel until Zerodha sends them to the exchange — typically before 8:57–9:10 AM depending on the segment.

Regular orders are placed during live trading hours; AMOs are queued after market hours for the next trading day.

Know the complete Zerodha Account Opening Process