Trade Smart account opening process: On this page, you will find in-depth information on how to open account in Trade Smart Online? You will also get information about Trade Smart account opening charges, required documents, latest offers on new accounts, online and offline process, account opening time, status of account opening. So that you can open your Trade Smart demat and trading account in the shortest possible time.

Trade Smart Online is a brand name of VNS Finance & Capital Services Limited. VNS Finance is a very old and reputed stock broker based in Mumbai. It was established by Mr. Vijay Singhania in 1994.

It has been providing stock broking services in the traditional way since 1994. In 2013, they also started offering discount brokerage services under the brand name of Trade Smart Online. And they succeeded. Trade Smart Online is named among the top 10 discount brokers in India. They currently have around 40,000 active customers and a daily turnover of 10,000+ cr.

Trade Smart Online is a registered stock broker with NSE, BSE, MCX and SEBI. They provide trading and investment services in Equity, F&O, Currency, Commodities and Mutual Funds.

Here are some reasons to consider a Trade Smart account while opening a new demat account.

The benefits of opening an account in Trade Smart online are as follows :

Below is the list of required documents for opening a Trade Smart Online account.

Note – All documents should be self-attested in case of offline account opening.

Trade Smart Online account opening charges are Rs 400 for trading and demat account. AMC charges are free for 1st year. From the 2nd year onwards, AMC charges for demat account is Rs 300 + GST per year.

There are additional Rs 200 charges for the Trade Smart commodity account. No AMC charges are applicable on the commodity trading account.

Trade Smart Account | Charges |

Trading And Demat Account | Rs 400 |

Demat Account AMC Charges | Rs 300 + GST |

Commodity Trading Account | Rs 200 |

Commodity Account AMC | N/A |

Note: AMC charges are free for the first year and Rs.300 + GST from the second year.

Current offers on new account opening in Trade Smart Online.

Above account opening offers are for a limited period. Sign Up quickly to avail this offer.

In Trade Smart Online, you can open an account either online or offline. Your mobile number must be linked to your Aadhaar card to open an account online. If not, you can open your account offline.

In the offline process, you can open your account by sending the account opening form and the required documents to the Trade Smart Online office.

Let’s take a look at both the processes of account opening.

The online account opening process is speedy and hassle-free. You can complete the online account opening form in just 20 minutes by clicking the button below.

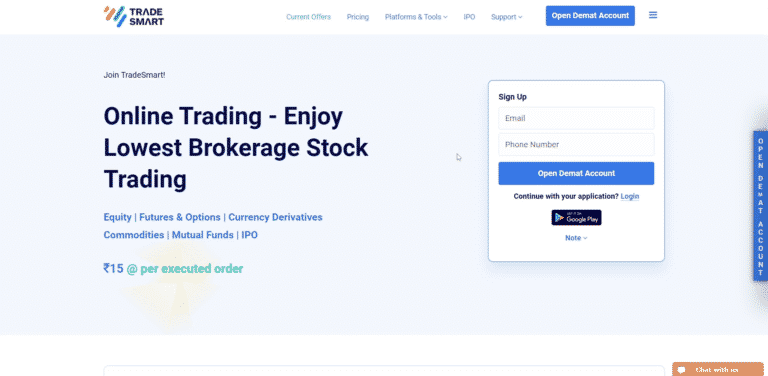

Step 1 – On this page, enter your email id, and mobile number and click on the Open Demat Account button. You will receive 6 digit OTP on your mobile number by SMS.

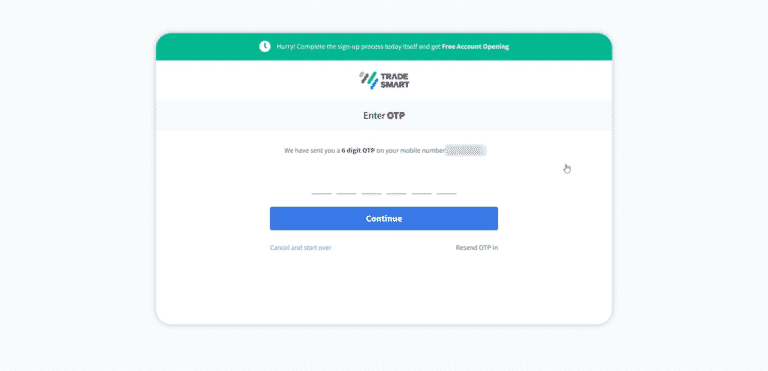

Step 2 – Enter the 6 digits OTP and click on Continue.

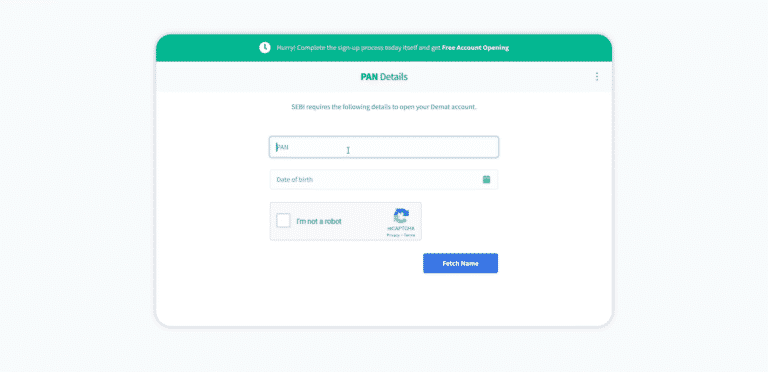

Step 3 – Now enter your Pan card details such as Pan number and Date of Birth to fetch your KYC details from CVL KRA. Also perform a captcha verification to prove that you are not a robot.

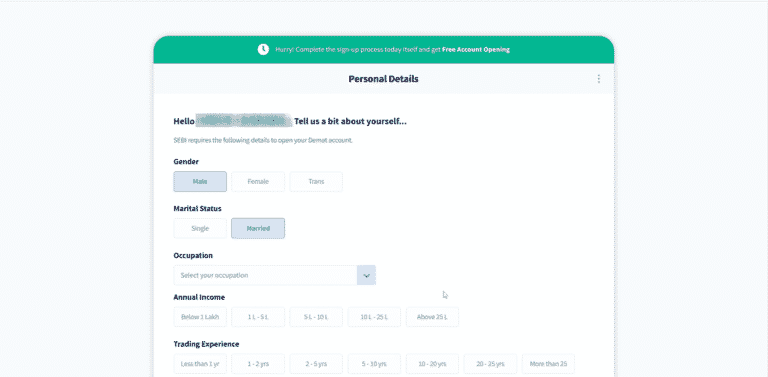

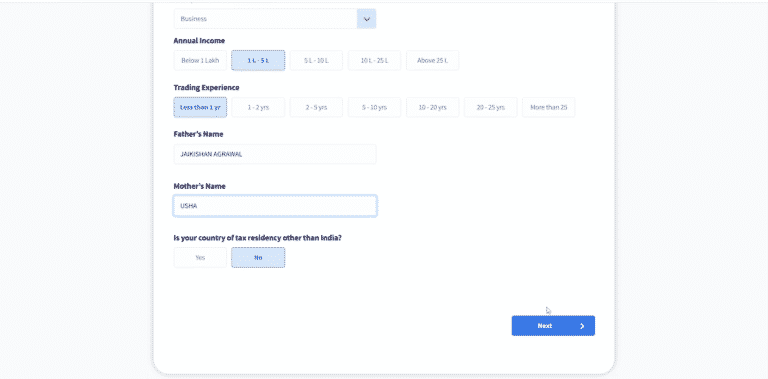

Step 4 – After fetching KYC details you will land on personal details page. On this page, select your appropriate personal information.

Step 5 – Now scroll down the page and fill your Father’s and Mother’s name. Click on the Next to continue.

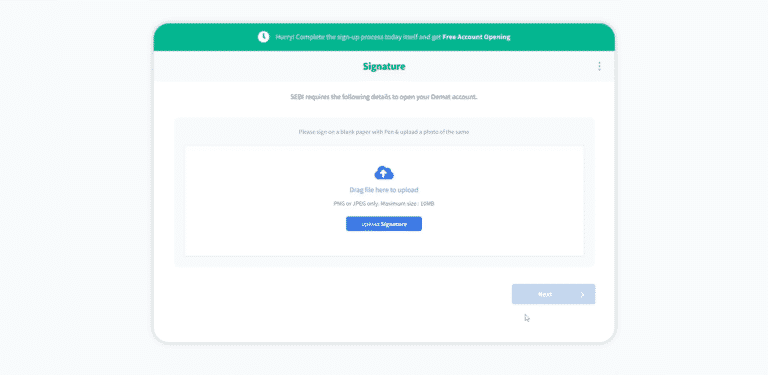

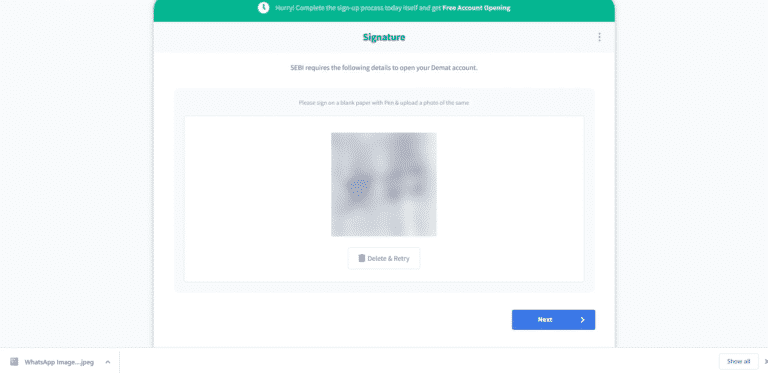

Step 6 – You need to upload your signature to open account in Trade Smart Online.

Step 7 – Sign on plain white paper as per your Pan card. Take a photo of the sign and upload it. Brokers keep this sign in their records. So that after the account opening, if you ever have to do any kind of paperwork, they can verify your paper document with this sign.

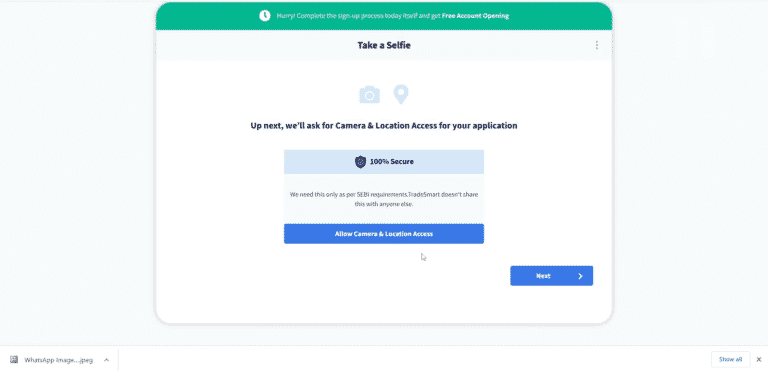

Step 8 – After uploading the signature, there is a step of in-person verification. In this, you have to take a live selfie in front of the camera. You will be asked permission to access the camera and location of your device.

Click on “Allow Camera & Location Access” here. Then click on Next.

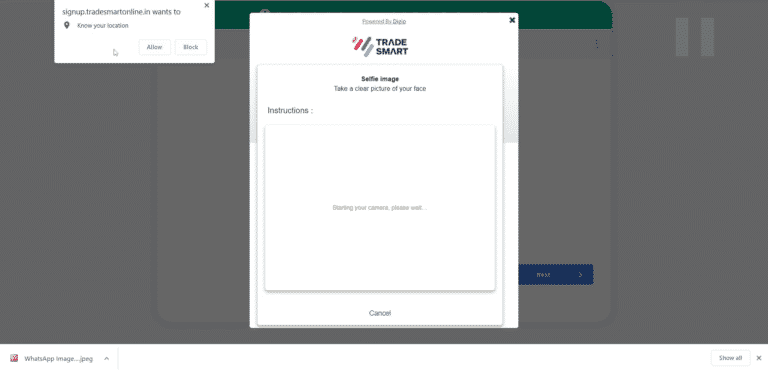

Step 9 – Allow location access on the next screen.

Step 10 – Now your camera is on. Take your selfie in it. Your face should be clearly visible in your selfie. Also, do not use a face mask or sunglasses while taking selfies.

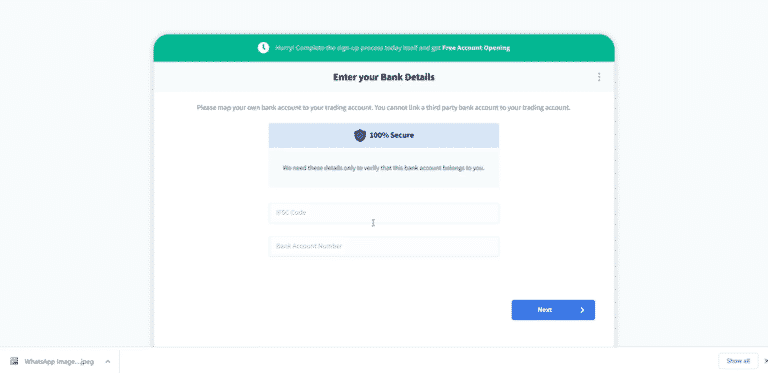

Step 11 – In the next step, your bank details will be asked. Enter the IFSC code and bank account number here. Remember, you can pay-in and pay-out your money only from the bank account you provide here.

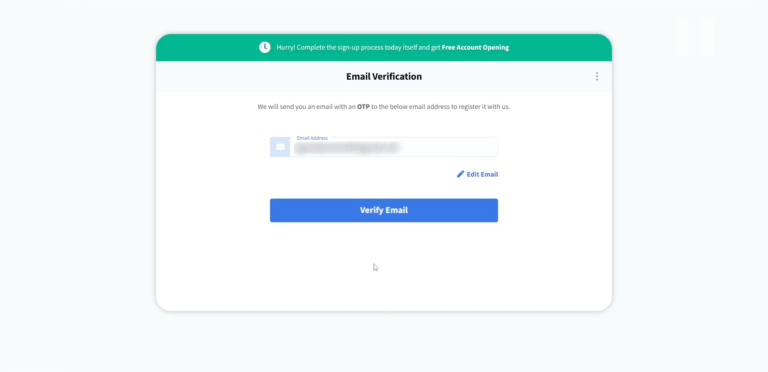

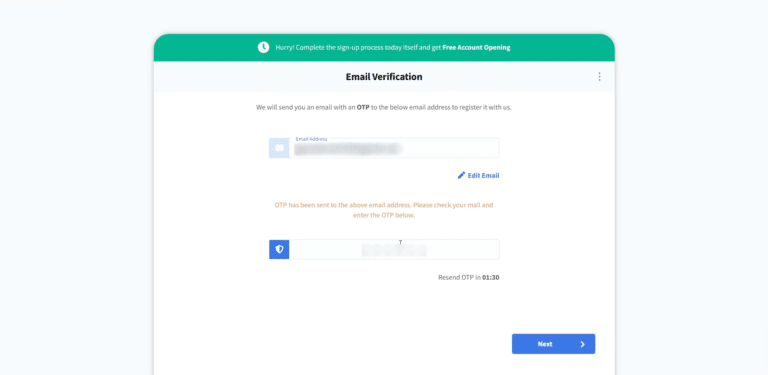

Step 12 – Enter the e-mail id here and click on verify e-mail. You will be sent an OTP by e-mail.

Step 13 – Fill the received OTP here. Then click on Next.

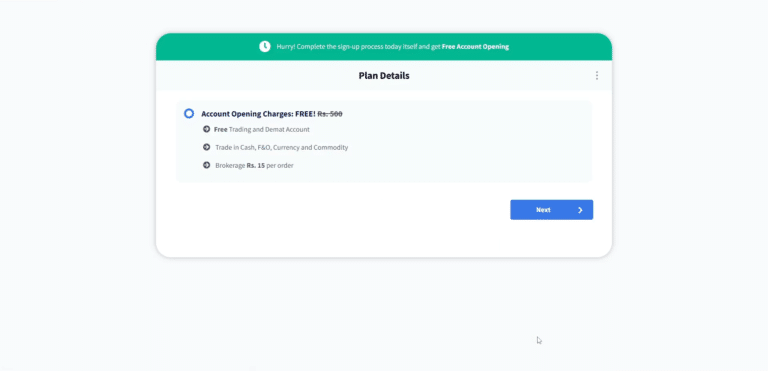

Step 14 – You will see your Trade Smart account charges, activating segments and brokerage charges in this step. Click on Next here.

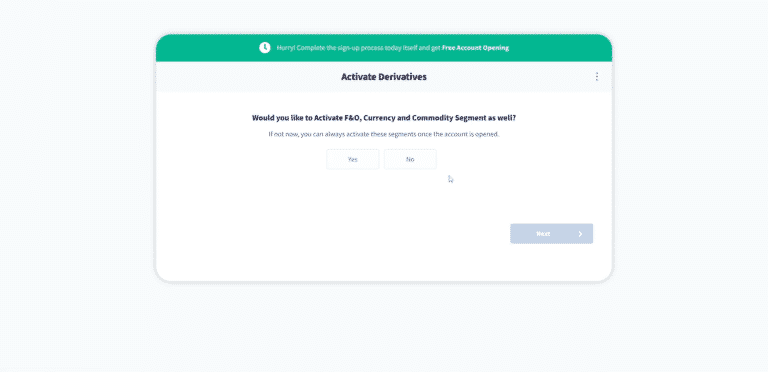

Step 15 – On the next page, you will be asked whether you want to activate the derivatives segment or not. Select your option Yes or No, and click on Next.

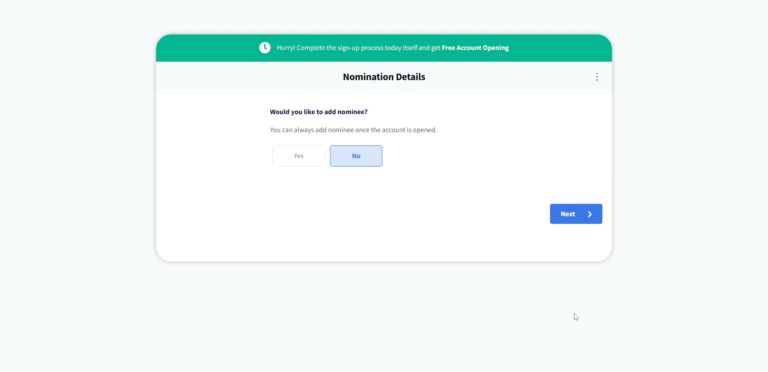

Step 16 – You will be asked if you want to add a nominee in this step. If you wish to add a nominee, select Yes. Otherwise, select No. Click on Next to proceed.

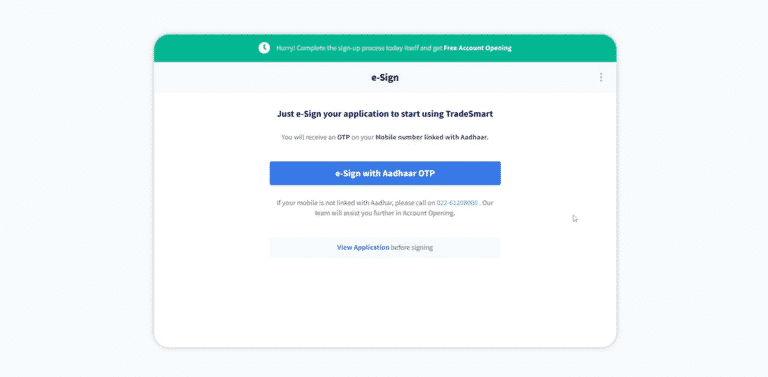

Step 17 – This is the last stage of the Trade Smart account opening process. You have to e-Sign your Trade Smart application and documents with Aadhaar OTP. For this, your mobile number must be linked to your Aadhaar card. Click on e-Sign with Aadhaar OTP to proceed.

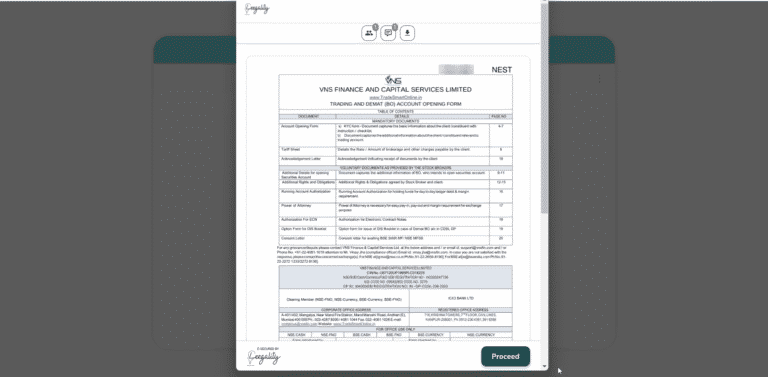

Step 18 – Your Trade Smart application form will appear. Review it properly and click on proceed.

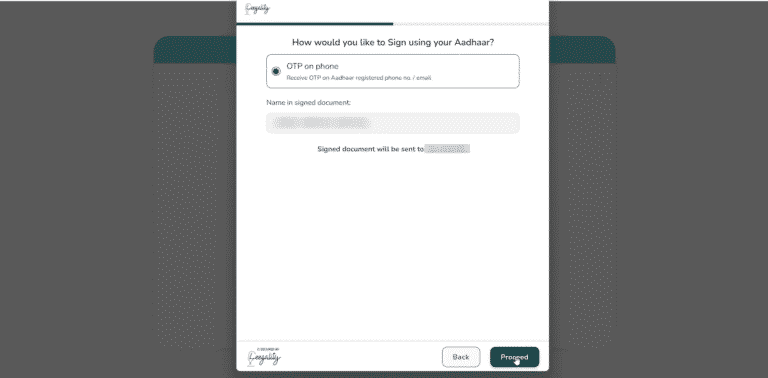

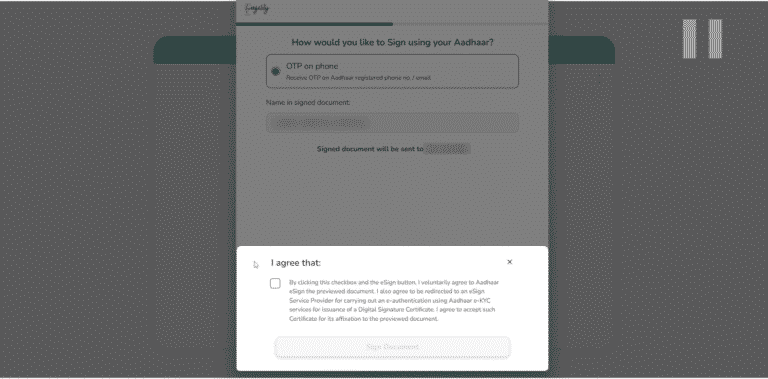

Step 19 – “OTP on Phone” will be selected here. Click on proceed.

Step 20 – Click on the checkbox stated “By clicking” to give your consent for Aadhaar eSign on your documents.

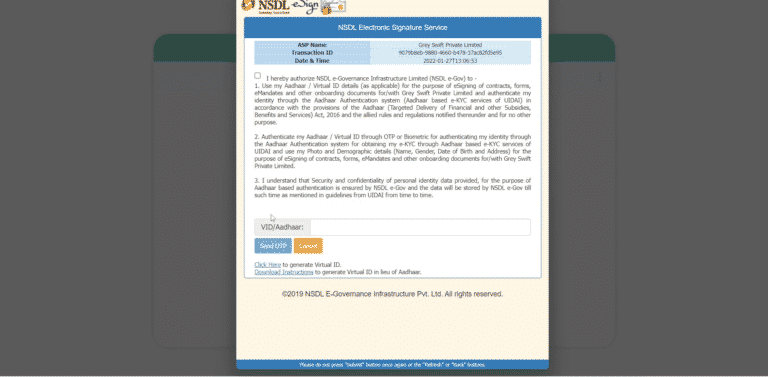

Step 21 – Click on the checkbox stating “I hereby” and fill in your 12 digit Aadhaar number. OTP will be sent to your mobile via SMS.

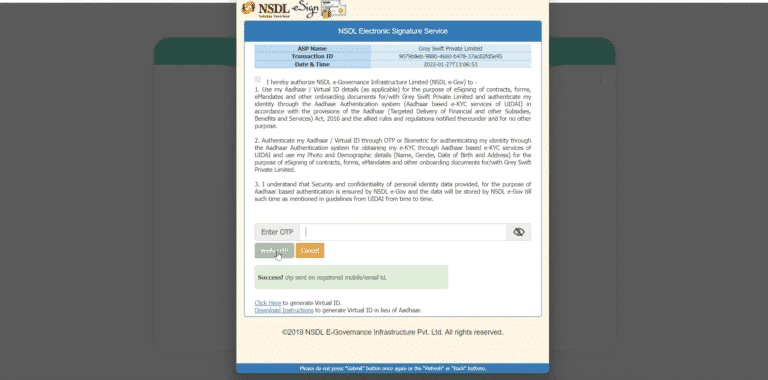

Step 22 – Submit the OTP you received and click on Verify OTP.

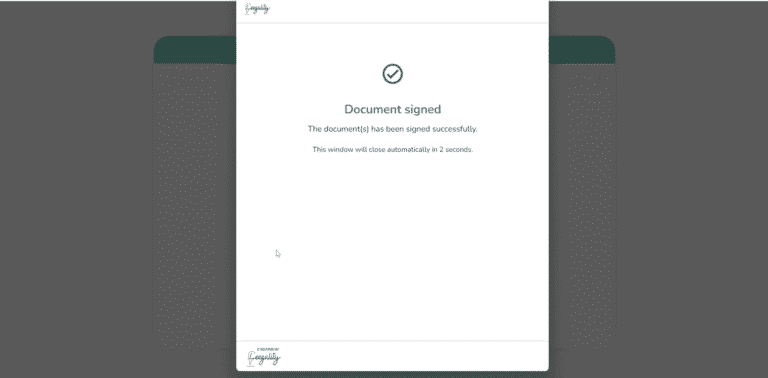

Step 23 – After submitting Aadhaar OTP, you will see a screen with green letters of signed documents. This means your Trade Smart Online account opening process is completed. This screen will close automatically after 3 seconds.

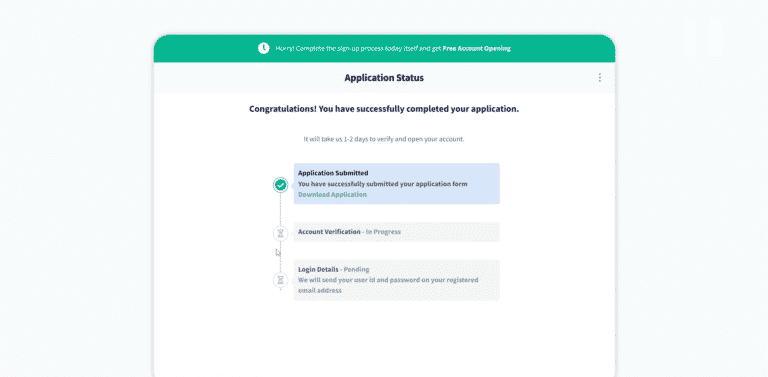

Step 24 – Here you will see “Congratulations! You have successfully completed your application”.

After completing all the above processes, you will see the status of your application. Now your application form will be verified. Once the application is verified, your account will be opened. Once the account is opened, your login details will be sent to your registered email id.

The offline process of opening an account is simple but time-consuming. It takes about 3-4 days for your account to be opened in the offline process.

Step 1 – Download Trade Smart account opening form here:

Step 2 – Fill complete form.

Step 3 – Sign the form where necessary.

Step 4 – Attach your self-attested documents with form.

Step 5 – Send the account opening form and required documents to Trade Smart office address by Indian Post or courier.

Trade Smart office address:

A-401, Mangalya, Marol, Andheri(E),Mumbai – 400 059.

If you filled the Trade Smart account opening form online, your account would open in 24 working hours. But if your account does not open within 24 working hours, you can check the status of your account opening by logging on to the same link you filled in the form.

It takes 2 working days for the account to be opened after your form reaches the Trade Smart office in the offline process. However, you can check your account opening status by calling the Trade Smart support team. Alternatively, you can check your account opening status through live chat by visiting Trade Smart website.

Once your Trade Smart account is opened, you can start trading online. For that, you can use the Trade Smart trading platform given below.

All the trading platforms mentioned above are free for Trade Smart users. Also, there is no maintenance fee for these trading platforms.

Trade Smart Online is a great discount broker. Which is managed by highly qualified and experienced promoters like Vijay Singhania and Vikas Singhania.

On the plus side, brokerage charges are low, the account opening is user-friendly, and customer support is exceptional.

On the negative side, Trade Smart Online charges brokerage for delivery trading.

Since there are no account opening charges and fast account opening, feel free to start the Trade Smart account opening process.

Yes, Trade Smart is very safe. Trade Smart is a member of reputed exchanges like NSE, BSE, and MCX. Also, it is regulated by SEBI. Trade Smart has been providing trading and investment services for almost three decades. Also, it is a very transparent stock broker with no hidden charges.

Account opening charges are Rs 400 at Trade Smart for trading and demat account. Additional Rs 200 charges if you wish to open a commodity account. If you want to open a Trade Smart account now, you can open your account for free. This offer is for a limited period. Sign up here to open Trade Smart account for free.

Yes, you will have to pay AMC charges even if you do not use your demat account for the entire year.

But Trade Smart gives you a facility in which you can open only trading account without opening a damat account. You can trade in F&O, currency, and commodities in this account. There is no facility for equity trading in this account.

If you fill out the online account opening form, your account will be open within 24 working hours. If you fill out the offline account opening form, your account will be open within 3 working days after it reaches the Trade Smart office.

No. Trade Smart Online does not charge its customers any hidden fees. All the charges charged by Trade Smart are available on their website.

You can fill Trade Smart account opening online form in just 10 minutes through your smartphone.

Read Trade Smart Review