Fyers Account Opening Process: In this post we will discuss how to open account in Fyers? Along with this, we will also discuss about the benefits of Fyers account and the features you get in it. Apart from this we will also discuss the documents required, account opening charges (fees), online and offline process of account opening in Fyers.

After reading this information, you can easily open Fyers account, even on the mobile phone.

Fyers is a reputed discount stock broker based in Bangalore. It is a member of NSE, BSE, and MCX and is regulated by SEBI. Also, it is counted among the top 10 best discount brokers in India with around 2,15,000 active clients.

Fyers provides trading and investment services in Equity, F&O, Currency, and Commodities. They also offer a unique service of thematic investment. In which you can invest in a portfolio of stocks designed keeping in mind the underlying ideas or logic of the investment.

There are many reasons to open demat account in Fyers.

Some of them are as follows.

To open an account with a stock broker, you need to submit some mandatory documents.

Fyers account opening documents.

Above documents are required to open Fyers demat account.

As mentioned above, Fyers account opening charges are free for trading and demat account. Also, the annual maintenance charges (AMC) on the demat account is free for lifetime. Click on the “Open An Account” button below to open Fyers demat account immediately.

Fyers Account | Charges |

Fyers Trading Account Charges | Rs 0 (Free) |

Trading Account AMC Charges | Rs 0 (Free) |

Fyers Demat Account Charges | Rs 0 (Free) |

Demat Account AMC Charges | Rs 0 (Free) |

Important Note: Fyers Lifetime AMC Free Offer is for a limited period of time. To avail this offer, sign up quickly.

If you open Fyers account now then you will get below offers. (Limited Period Offer)

There are two ways to open trading and demat account in Fyers. Online and Offline.

In the online method, your Aadhar card should be linked to an active mobile number. So that you can receive OTP for E-sign verification.

If the mobile number is not linked to the Aadhar card, you can follow the offline account opening process.

Opening an account with the online process in Fyers is very easy and time-saving.

In this process, you have to visit the website of Fyers and follow the instructions given below. By doing this, you can complete the Fyers online account opening process in just 15 to 20 minutes.

So let’s start the Fyers account opening online process.

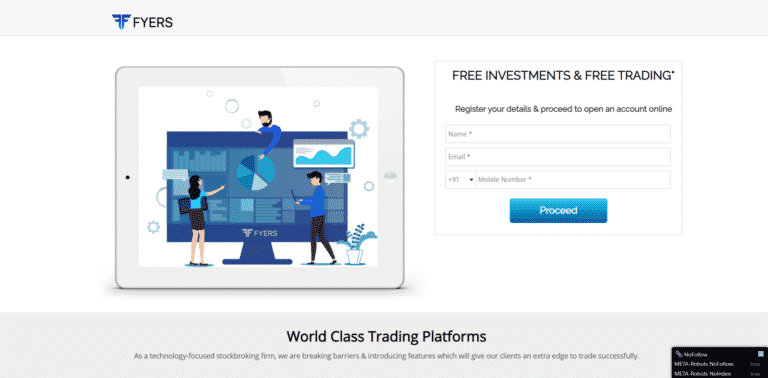

First of all, click on the button given below. By clicking on this button, you will redirected to Fyers account opening page in a new tab.

Step 1 – Enter your name, email id, and mobile number here and click on the Proceed button.

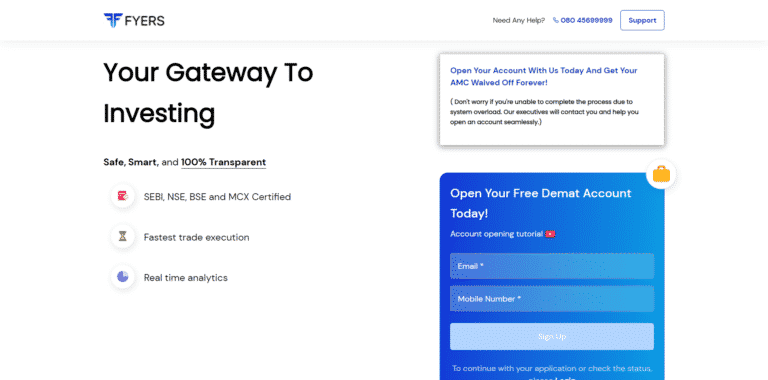

Step 2 – Again enter your email id and mobile number. Click on the Sign up. Now you will receive 6 digit OTP on your mobile number and email id.

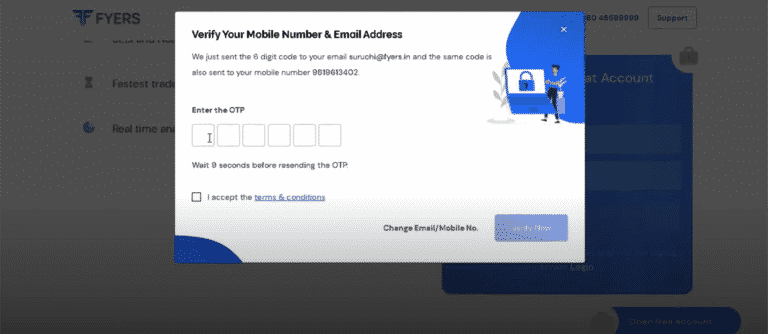

Step 3 – Enter the 6 digit OTP you received. Click on the checkbox that shows “I accept the terms & conditions” and click on the “Verify Now” button.

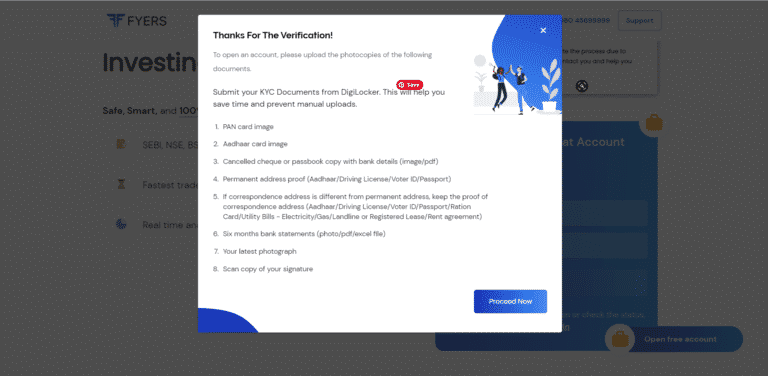

Step 4 – After verification, now you will be asked to keep the above mentioned documents ready, such as PAN card, Aadhar card, bank proof, address proof etc. After preparing all the documents given in the screen, click on proceed now.

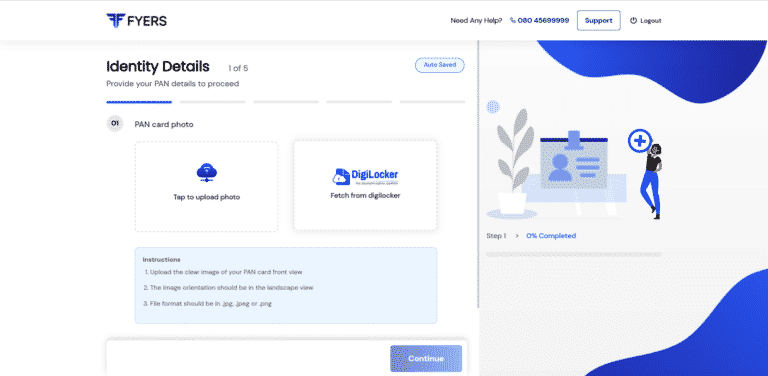

Step 5 – Now you have to upload your PAN card. You can upload a Pan card copy directly from your device or fetch it from Digilocker. After uploading the PAN card copy, click on continue.

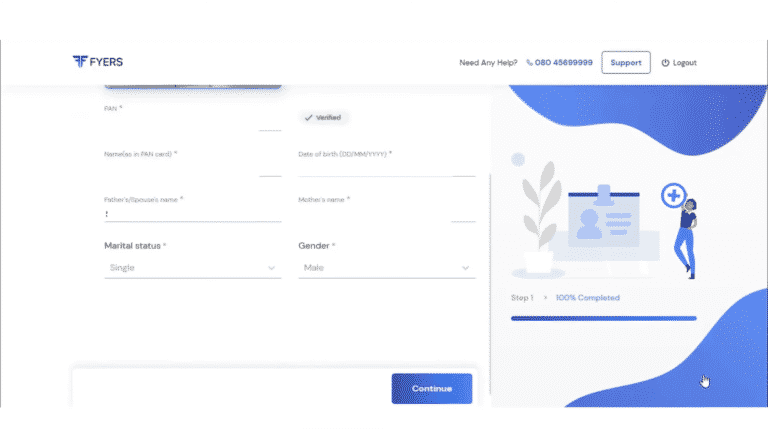

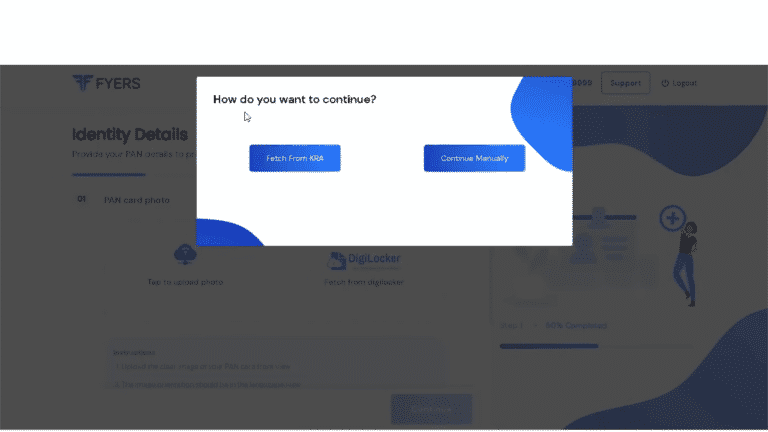

Step 6 – Now your PAN card has to be verified. You can fetch it from the central KRA or manually verify it. For this, you will be asked your personal information such as mother’s name, father’s name, your marital status and gender.

Click on continue to verify.

Step 7 – Verify PAN with your suitable option.

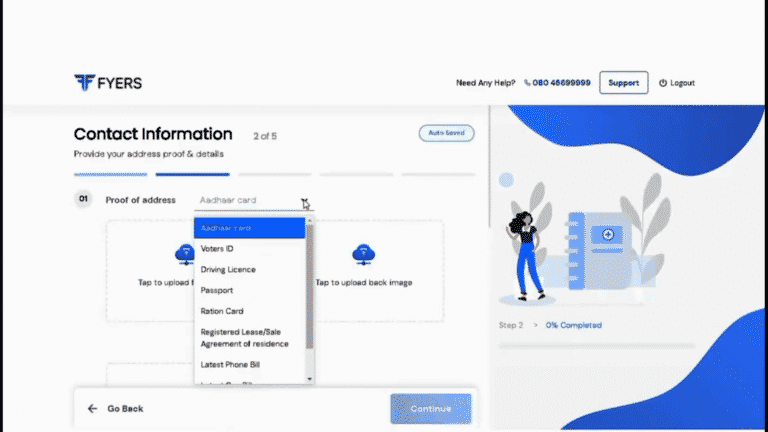

Step 8 – After uploading the PAN card, you have to upload the address proof copy. You can give any one document out of Aadhar Card, Voting ID, Passport for address proof. Upload front and back copies of the Aadhar card for ease. After uploading the address proof click on continue.

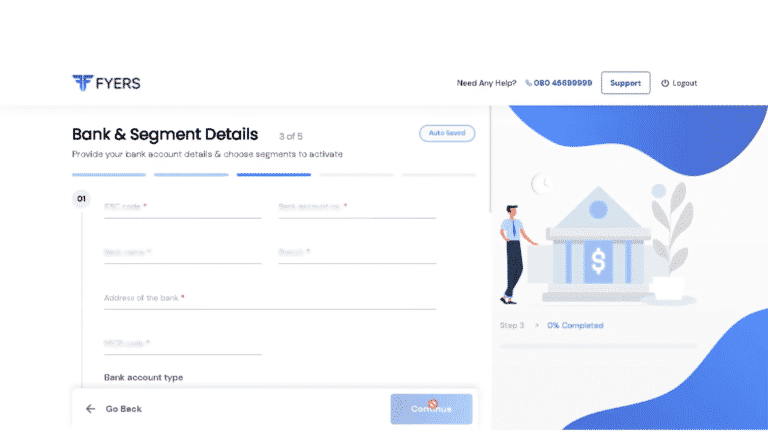

Step 9 – Now you have to fill the bank details. Here you have to fill IFSC code of your bank, bank account number, bank name, branch, bank address, and MICR code. After that select bank type.

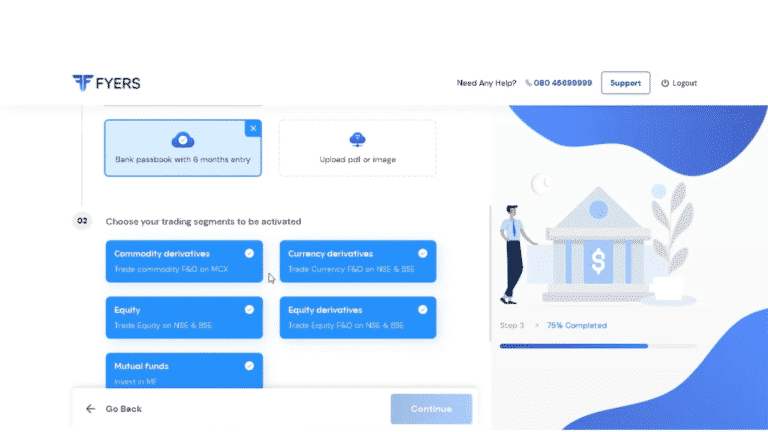

Now the bank proof has to be uploaded. You can upload the canceled check leaf. Instead of canceled cheque, you can upload a first page of passbook with 1 month statement. (For trading in F&O, add 6 months statement)

Step 10 – Select the segment in which you want to trade. By opening an account in Fyers, you can trade in Equity, F&O, Currency, and Commodity. You can also invest in Mutual Funds. After selecting the segment, click on Continue.

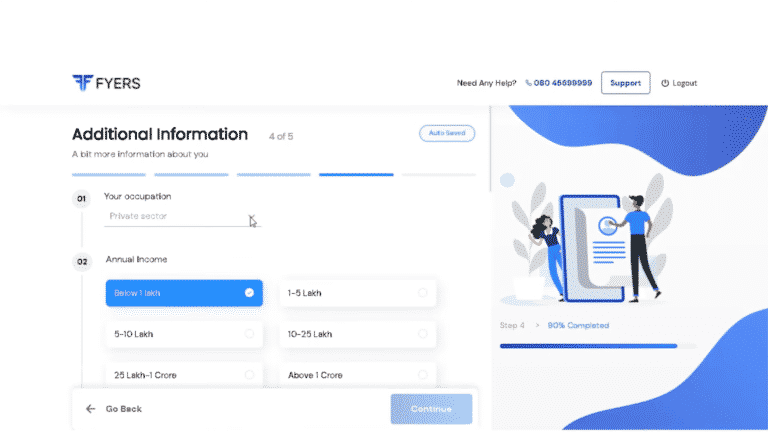

Step 11 – After selecting the segment, you will be asked some additional information, such as your occupation and annual income. After giving this information, the next step is in-person verification.

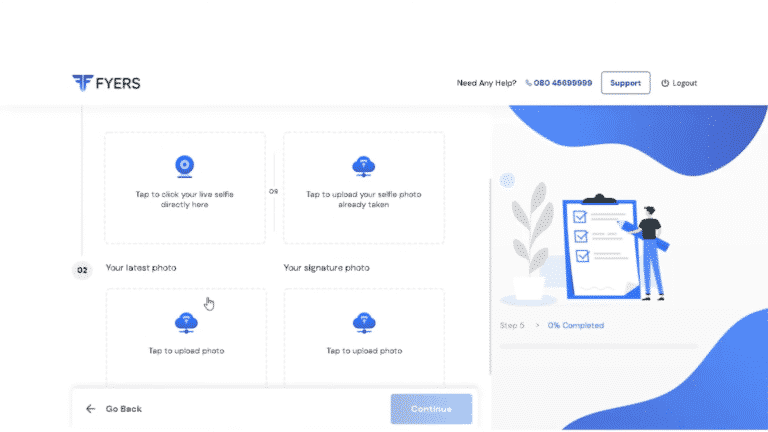

Step 12 – For in-person verification, you will be shown a 6 digit code on the screen. Write this code on white paper and take your selfie with it and upload it. You can either take a live selfie.

After that upload your passport size photograph and specimen signature.

Click on Continue.

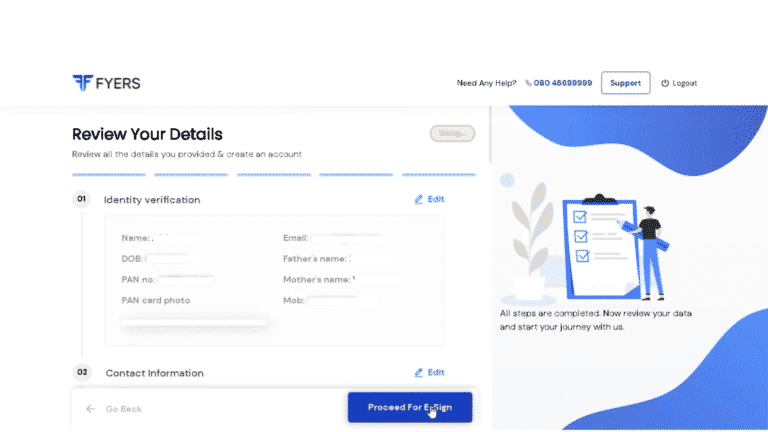

Step 13 – After uploading the documents, you will be asked to review your details. After reviewing the details, click on Proceed to E-Sign.

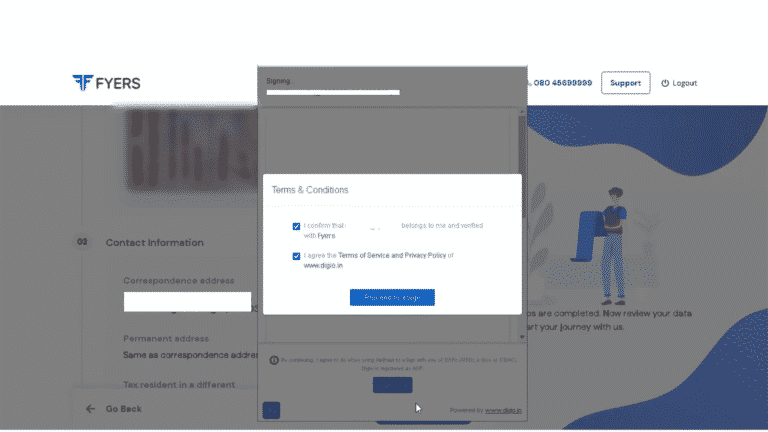

Step 14 – A popup window for the terms and conditions of Fyers will open. Click on the check box stating “I confirm” and “I agree”. Then click on “Proceed to eSign”. It will redirect you to the NSDL page.

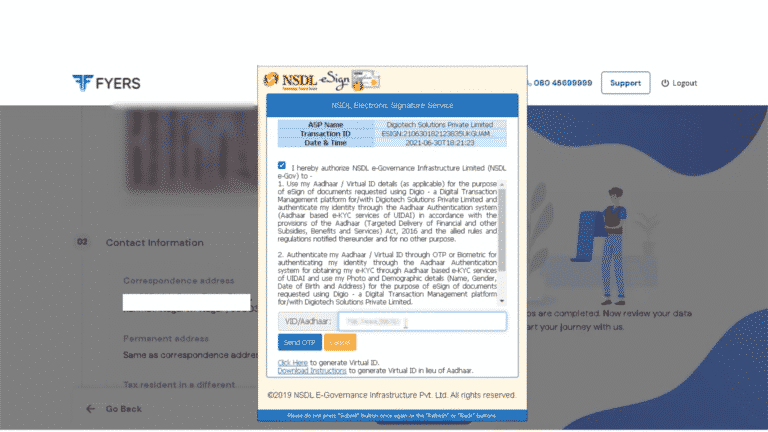

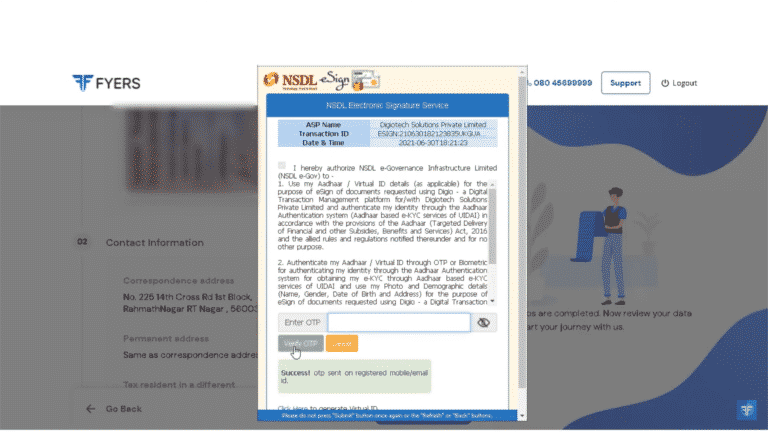

Step 15 – After reaching the page of the NSDL, click on the checkbox that shows “I hereby” and then enter your aadhaar number and click on send OTP.

Step 16 – Now complete your Fyers account opening process by entering the OTP.

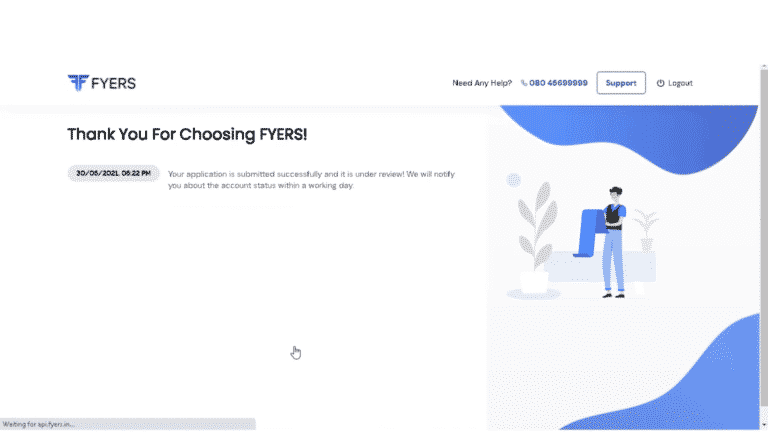

Step 17 – After completing all the above processes, you will see the “Thank You For Choosing Fyers!” on your screen.

Upon completion of the above process, your form along with your documents will be received by the Fyers KYC team. Your documents will be verified by the KYC team and your trading and demat account will be opened in Fyers. Account opening information and login credentials will be sent to you by email. This process takes approximately 24 working hours.

If the active mobile number is not linked to your Aadhar card. In that case, you can follow the Fyers offline account opening process.

To open an offline account, you need to register your basic details here. After registration, you can send the account opening form directly to the Fyers registered office.

Step 1 – Download the Fyers account opening form here.

Step 2 – Fill the form properly and completely.

Step 3 – Sign the form where necessary.

Step 4 – Attach the required self-tested documents along with the form.

Step 5 – Send the duly signed account opening form along with mandatory documents to Fyers registered office by Indian Post or courier.

Fyers office address:

No. 77, Nandidurga Cross Road (Anjenaya Temple Cross), Jayamahal, Bangalore – 560046.

The offline process of account opening is simple but time consuming and expensive. Therefore, online process should be preferred while opening an account.

Your Fyers account is usually opened within 24 hours of completing the account opening process. After opening the account, the complete information is sent to you by e-mail.

However, if you have not received the e-mail within 24 hours, you can check your account opening status by calling 080-66251111 or 080-46251111.

Once your account has been successfully opened, you can start trading by installing the Fyers trading platform. For that, you can download the Fyers App or Fyers One. Additionally, you have the option of Fyers Web.

Below are links to Fyers trading platforms.

These platforms are available for free to Fyers customers.

Fyers is one of the best discount brokers in India and charges very low brokerage.

However, being new to the industry, it has some drawbacks. Still, they are increasing their ability to serve you better. And the service they offer you is very satisfying compared to their pricing.

Well, this is the end of Fyers account opening process. However, if you are still confused about how to open account in Fyers? Please comment below.

Yes. Account opening in Fyers is absolutely free. Fyers does not charge any fees for account opening.

If your form is filled out properly and all the documents are correctly submitted. In that case, your Fyers account will be opened within 24 hours. After that, the Fyers account opening team will assign you a Unique Client Code (UCC). If there are any discrepancies, Fyers sales team will contact you to help.

Further documents are required to open your account in Fyers. Keep it handy to avoid delays in the account opening process.

Your Fyers account is typically opened within 24 hours of completing the account opening process. After opening the account, the Fyers KYC team e-mails you the details of your account.

However, if you do not receive the e-mail within 24 hours, you can check your account opening status by calling 080-66251111 or 080-46251111.

Follow the steps given below to open an account in Fyers.

After completing all the above steps, your Fyers account will be opened within 24 hours.

Read the complete Fyers Securities Review.

2 thoughts on “Fyers Account Opening Process”

How can i join fyer if am not indian

You can’t join Fyers if you’re not Indian, as they only accept Indian residents with valid documents.